The Most Promising Countries for Real Estate Investment in 2026: A Global Ranking

September 29, 2025

Ranking the Most Promising Countries for Real Estate Investment in 2026 — Where to Put Your Capital

Short summary: This comprehensive guide ranks the most promising countries for real estate investment in 2026. It blends market analysis, practical investment tips, risk management strategies, and long-tail keyword optimization to help investors find high-yield opportunities and long-term capital appreciation.

Table of contents for the article

ToggleIntroduction: Why 2026 Is a Turning Point for Global Real Estate

Global real estate markets are undergoing transformational shifts driven by demographic change, nearshoring, infrastructure upgrades, and the rise of remote work. Choosing the best countries to invest in real estate in 2026 requires a blend of macroeconomic insight and on-the-ground local knowledge. This article ranks the top countries poised for growth, explains why they stand out, and offers actionable advice for investors seeking strong rental yields, capital appreciation, and regulatory safety.

How We Ranked Countries: Key Investment Criteria

To identify the most promising countries for property investment in 2026, we assessed each market against a set of objective criteria. These criteria form the backbone of a data-driven property investment approach.

1. Macroeconomic stability and GDP growth

Countries with stable growth and predictable monetary policy offer safer long-term returns. Look for steady GDP growth, manageable inflation, and central bank transparency.

2. Legal framework and property rights

Clear title registration, predictable zoning, and enforceable contracts reduce legal risk. Nations with transparent judicial systems and robust property rights land higher on the ranking.

3. Demographics and urbanization

Young populations, sustained urban migration, and increases in household formation drive housing demand — which leads to rising rents and property values.

4. Infrastructure investments

Major transport projects, airport upgrades, and digital connectivity improve property values. Areas with new metro lines, logistics hubs, or smart-city plans often enjoy faster capital appreciation.

5. Yield and cost of entry

We weighed typical rental yields and the average cost per square meter against expected capital growth. High-yield/low-cost markets are attractive for income investors; high-cost/high-growth markets suit long-term capital gain strategies.

6. Risk factors

We accounted for currency risk, political volatility, climate vulnerability, and regulatory changes — essential factors for international portfolio diversification.

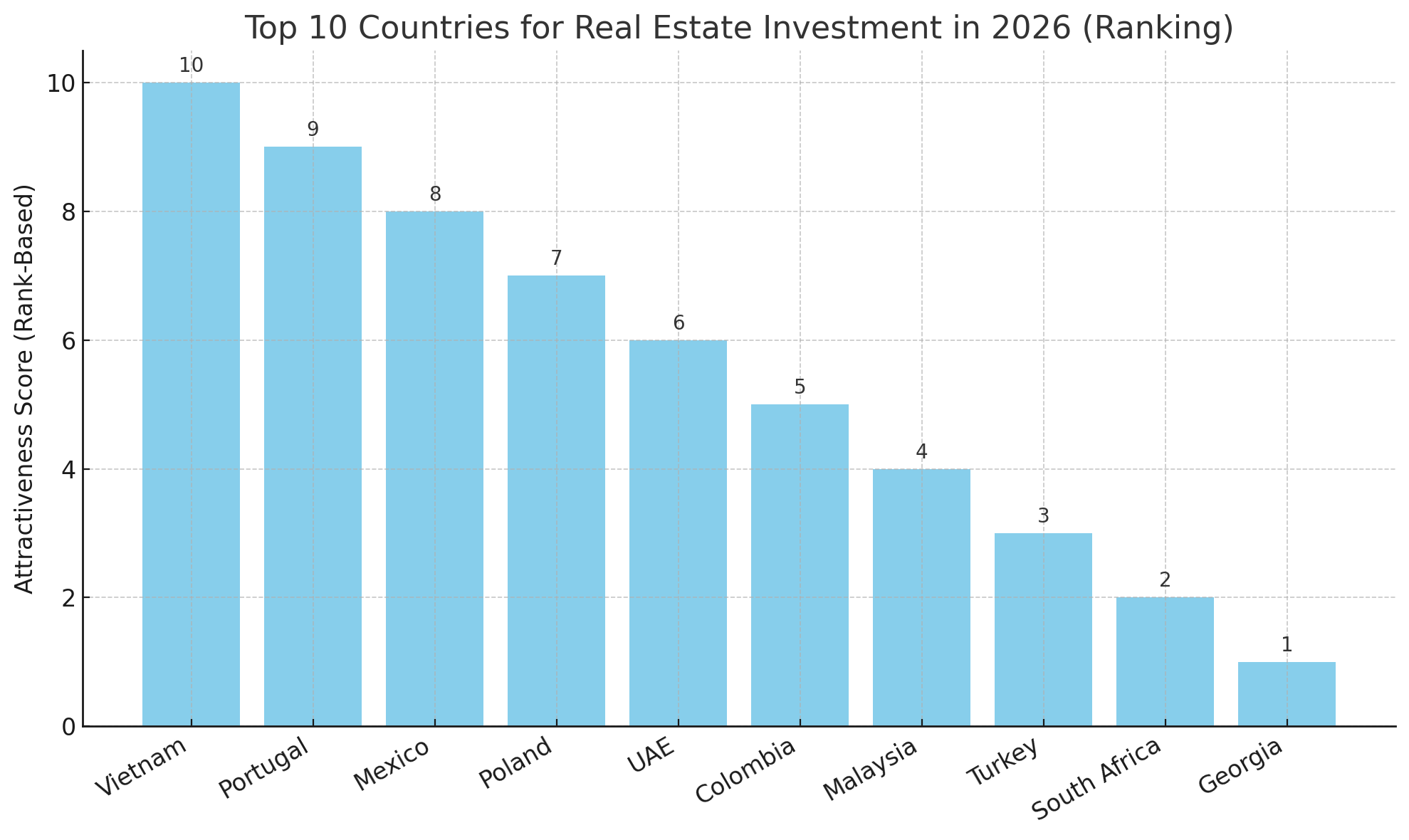

Top 10 Most Promising Countries for Real Estate Investment in 2026

Below is our list of the ten countries most likely to deliver strong real estate returns in 2026, ranked by a balance of growth potential, legal certainty, yield prospects, and investor accessibility.

1. Vietnam — High Growth, Young Demographics, Rapid Urbanization

Why Vietnam ranks #1

Vietnam continues to lead in Southeast Asian GDP growth with robust manufacturing inflows, rising exports, and an expanding middle class. Cities like Ho Chi Minh City and Hanoi are experiencing intense housing demand. For emerging markets for property investment, Vietnam stands out due to its rental yield potential, dynamic population growth, and improving legal clarity on foreign ownership.

Market snapshot

- Typical yields: 5–7% in major cities for well-located apartments and serviced residences.

- Primary drivers: Foreign direct investment, urbanization, infrastructure upgrades (metros, airports).

- Main risks: Regulatory evolution (land-use rights), potential overheating in speculative pockets.

Tip: Focus on newly connected neighborhoods near metro lines and business districts for best capital appreciation.

2. Portugal — EU Stability, Tourism and Remote-Worker Demand

Why Portugal ranks #2

Portugal’s stable legal framework (EU member) and high quality of life attract retirees, remote workers, and international buyers. Lisbon, Porto, and the Algarve remain consistent performers for capital appreciation and tourism-driven rental demand. Although prime yields are modest, the market’s low regulatory risk and visa-friendly policies keep Portugal a top pick.

Market snapshot

- Typical yields: 3–5% in central Lisbon/Porto; higher in secondary coastal towns.

- Primary drivers: Golden Visa programs (subject to evolving policy), tourism, remote work influx.

- Main risks: Potential regulatory tightening on short-term rentals; seasonal variability.

3. Mexico — Attractive Coastal Markets and Nearshoring Benefits

Why Mexico ranks #3

Mexico benefits from manufacturing nearshoring, a strong tourist economy, and an extended diaspora that fuels property demand. Coastal hotspots like Cancún, Playa del Carmen, and Los Cabos plus border cities near the U.S. offer strong rental yields and capitalization prospects. Mexican law allows foreigners to hold property using clear structures where necessary (fideicomiso / trust in restricted zones).

Market snapshot

- Typical yields: 6–8% in tourist and expat-heavy locations.

- Primary drivers: Tourism, nearshoring of manufacturing, cross-border investment.

- Main risks: Security issues in certain regions; exchange-rate volatility.

4. Poland — Stable EU Market with Tech & Logistics Demand

Why Poland ranks #4

As a hub for EU manufacturing and IT outsourcing, Poland’s major cities (Warsaw, Kraków, Wrocław) show steady rental and commercial property demand. Logistics space and purpose-built rental housing remain strong sub-sectors. Foreigners face minimal barriers to property ownership and benefit from EU-aligned legal protections.

Market snapshot

- Typical yields: 4–6% for residential; commercial yields vary by type.

- Primary drivers: EU investment, relocations, young professional migration.

- Main risks: Regional disparities, possible regulatory changes affecting landlords.

5. United Arab Emirates — Premium Market, Luxury, and Business Hubs

Why UAE ranks #5

Dubai and Abu Dhabi continue to attract international capital due to world-class infrastructure, tax-friendly regimes, and global connectivity. Freehold zones encourage foreign investment. For investors targeting short- to medium-term capital appreciation and premium rental markets, the UAE is compelling.

Market snapshot

- Typical yields: 5–7% in well-located Dubai properties.

- Primary drivers: Tourism, business events, international relocation.

- Main risks: Supply cycles, potential for oversupply in luxury segments.

6. Colombia — Strong Yields in Growing Urban Centers

Why Colombia ranks #6

Improved security, steady GDP growth, and rising urban demand make Colombia attractive. Bogotá, Medellín, and Cartagena present opportunities for both long-term rent and tourism-driven short-term rentals. Foreign buyers can generally hold property under the same conditions as locals.

Market snapshot

- Typical yields: 6–8% depending on zone and property type.

- Primary drivers: Urbanization, digital nomads, tourism.

- Main risks: Currency risk; bureaucratic delays in permitting.

7. Malaysia — Affordable Entry and Regional Demand

Why Malaysia ranks #7

Malaysia offers comparatively low cost of entry and a business-friendly environment. Penang, Johor, and Kuala Lumpur attract regional buyers and cross-border investors from Singapore and China. The combination of solid yields and strong infrastructure projects places Malaysia on our list.

Market snapshot

- Typical yields: 5–6% in suburban and satellite-city locations.

- Primary drivers: Cross-border demand, affordability, infrastructure.

- Main risks: Regulations concerning minimum purchase prices for foreigners.

8. Turkey — High Yield Potential for Risk-Tolerant Investors

Why Turkey ranks #8

Turkey’s tourism hubs and coastal resorts provide strong yields. Currency depreciation has made Turkey an attractive market for foreign currency investors. But the market is more volatile than Western alternatives and better suited for investors comfortable with higher risk for potentially higher returns.

Market snapshot

- Typical yields: 6–9% in tourist and coastal areas.

- Primary drivers: Tourism, affordability for foreign buyers, redevelopment projects.

- Main risks: Currency instability, inflation, political volatility.

9. South Africa — High Yields in Select Urban Areas

Why South Africa ranks #9

South Africa offers high yields in well-chosen urban districts and tourist zones. Cape Town and Johannesburg remain the core markets, with steady demand from both locals and international tourists. Legal structures allow foreigners to buy property, though investors must weigh safety and infrastructure issues.

Market snapshot

- Typical yields: 6–8% in selected neighborhoods.

- Primary drivers: Tourism, local rental demand, diverse property stock.

- Main risks: Crime, service delivery issues, currency depreciation.

10. Georgia (country) — Liberal Rules and Low Cost of Entry

Why Georgia ranks #10

Georgia offers transparent processes for foreign buyers, favorable taxation, and affordable entry costs. Tbilisi and Batumi have growing appeal for tourists, digital nomads, and retirees. The market is smaller and less liquid than Western markets, but the potential for upside is meaningful.

Market snapshot

- Typical yields: 5–7% in key urban and coastal hubs.

- Primary drivers: Visa-friendly policies, economic reform, low taxes.

- Main risks: Liquidity constraints, regional geopolitical risk.

Emerging Markets to Watch

Beyond the top ten, several countries present early-stage opportunities for investors willing to accept higher risk for potentially outsized returns:

Philippines

Fast-growing Metro Manila, Cebu, and other secondary cities show promising development pipelines. The Philippines benefits from strong remittances and a large diaspora.

Kenya and East Africa

Nairobi and Mombasa attract logistics and urban renewal investment. Infrastructure projects and foreign capital are increasing, though governance and regulatory risk are elevated.

Selected Eastern European and Balkan states

Albania, parts of Serbia, and Bosnia show increased tourism and low entry prices. These markets require careful due diligence.

Practical Tips for Investing Abroad

Investing internationally requires a structured approach. Below are practical, actionable steps to reduce risk and improve returns.

1. Run a full financial model

Include purchase costs, taxes, insurance, maintenance, vacancy rates, property management fees, and conservatively estimated rental income. A 10–20 year cash-flow projection helps clarify long-term returns.

2. Understand local ownership rules and taxes

Research purchase taxes, annual property taxes, capital gains tax, inheritance laws, and repatriation limits. When in doubt, consult a local tax lawyer.

3. Use local experts

Work with licensed brokers, reputable local attorneys, and property managers. Local partners reduce fraud risk and navigate administrative hurdles more efficiently.

4. Diversify geographically and by asset type

Spread investments across multiple countries and property types: long-term rentals, short-term/Tourist rentals, commercial spaces, and logistics warehouses. Diversification smooths volatility.

5. Mitigate currency risk

Consider local-currency financing, currency hedging strategies, or holding a foreign-currency reserve to cushion exchange-rate swings.

Common Pitfalls and How to Avoid Them

Even experienced investors can be tripped up. Below are common traps and concrete mitigations.

Overpaying because of hype

A void buying solely on FOMO. Conduct comparable sales analysis and stress-test valuations against discounted cash-flow assumptions.

Ignoring recurring costs

Factor in property management fees, utilities, HOA dues, local levies, and periodic renovation costs. These reduce net yield and can surprise inexperienced investors.

Regulatory shocks

Tax law changes or restrictions on short-term rentals can dramatically alter returns. Build legal flexibility into contracts and have exit strategies.

Mini Guides: Investment Playbooks by Investor Type

Income-focused investor

Target these priorities: higher rental yields, predictable tenant demand, and low vacancy. Markets such as Mexico (coastal rentals), Colombia (urban rentals), and South Africa (select neighborhoods) fit this profile.

Growth-focused investor

Seek capital appreciation through urbanizing markets, infrastructure corridors, and regeneration zones. Vietnam, Poland, and Portugal’s secondary cities can deliver appreciation potential.

Balanced investor

Mix stable EU or GCC markets (Portugal, UAE) with one or two higher-yield emerging markets (Vietnam, Mexico). Use local debt where available to enhance returns while leveraging conservative LTV ratios.

An Investor’s Pre-Purchase Checklist

- Verify title & land registry records with a local attorney.

- Obtain a market rental survey and vacancy analysis.

- Estimate all taxes, closing costs, and recurrent fees.

- Confirm foreign ownership rules and residency implications.

- Factor in repatriation rules for rental and sale proceeds.

- Plan for an exit strategy: resale options, liquidity, and timeline.

Conclusion: How to Use This Ranking for Your Investment Plan

Investing in global real estate in 2026 means balancing growth, yield, and legal certainty. Our ranking highlights 10 countries—Vietnam, Portugal, Mexico, Poland, UAE, Colombia, Malaysia, Turkey, South Africa, and Georgia—that represent attractive mixes of those factors. Your personal allocation should reflect your risk tolerance, investment horizon, and the liquidity you need.

Final advice: conduct rigorous local due diligence, work with trusted local partners, and build a diversified portfolio that blends stable markets with higher-potential emerging markets. Use the checklist above before every purchase.