Life, Real Estate Investments, and Future Opportunities in Saudi Arabia

November 19, 2025

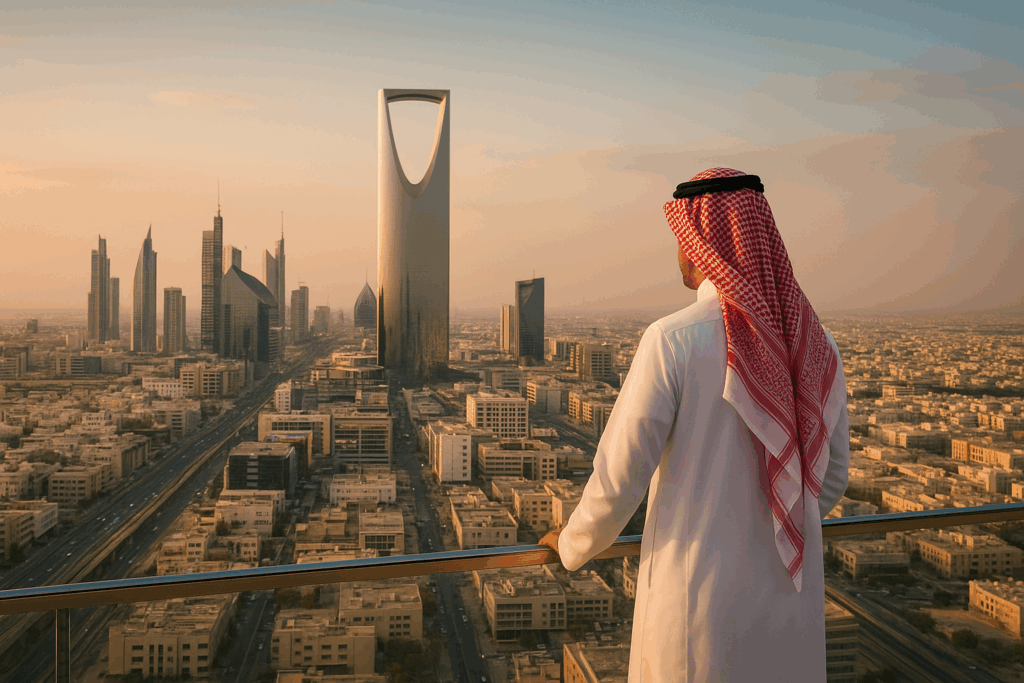

A NEW CHAPTER FOR THE KINGDOM

Saudi Arabia is entering a revolutionary era. Known for decades primarily as the world’s leading oil exporter, the Kingdom is now transforming its identity on a global scale. It is positioning itself as a hub of innovation, real estate development, tourism, technology, entertainment, and international business. The transition is not random — it is part of a carefully designed strategy called Saudi Vision 2030, a long-term national plan led by Crown Prince Mohammed bin Salman.

Table of contents for the article

ToggleSaudi Arabia is now investing trillions of dollars into futuristic cities, digital infrastructure, tourism projects, luxury residential zones, and environmentally sustainable solutions. The country is moving beyond oil — and moving toward a diversified, future-ready economy. This creates immense opportunities for investors, entrepreneurs, expats, and real estate developers from all over the world.

The world is watching closely. Many are already asking the question:

Is Saudi Arabia the next Dubai—or something even bigger?

WHY THE WORLD IS TURNING ITS ATTENTION TO SAUDI ARABIA

The Kingdom is at a strategic crossroads:

✔ Asia to the East

✔ Europe to the West

✔ Africa to the South

This geographical advantage makes it a trade, logistics, business, and investment hub with direct access to global supply chains. But geography alone is not the main reason why Saudi Arabia is attracting attention — it’s the speed of transformation that surprises global analysts.

Just 10 years ago, Saudi Arabia was considered a conservative and closed country. Today, it hosts international events, Formula 1 races, major business conferences, concerts, real estate expos, and tourism festivals. Foreign ownership laws are being adjusted, investment visas are being issued faster, and global companies are opening offices here every month.

Saudi Arabia is sending a very clear message to the world:

“We are open for business — and we are building the future.”

THE STRATEGY BEHIND THE TRANSFORMATION: SAUDI VISION 2030

Saudi Vision 2030 is the engine powering this change. It is a comprehensive national strategy focused on three core goals:

Economic diversification – reducing dependence on oil

Social development – improving the quality of life and public services

Investment attraction – opening the market to global investors

This means that Saudi Arabia is not only expanding — it is actively redesigning its economic architecture. The government is investing heavily in:

Smart housing projects

Technological infrastructure

Tourism and hospitality

Urban development and transport

Renewable energy

Entertainment and culture

Each of these sectors directly influences real estate demand, making Saudi Arabia a new investment magnet.

MEGA-PROJECTS THAT WILL CHANGE THE COUNTRY

Saudi Arabia is building some of the most ambitious projects in the world. These are not just construction initiatives — they are strategic urban ecosystems designed to attract millions of residents, tourists, and investors.

Below are the most important mega-projects shaping the future of real estate in the Kingdom:

NEOM – The $500 Billion Smart City

A futuristic city being built from scratch in northwest Saudi Arabia. Powered by renewable energy, NEOM aims to host entrepreneurs, engineers, researchers, and high-income residents from around the world. It is expected to become a global hub for innovation and lifestyle.

The Line – A City with No Cars and No Pollution

A revolutionary concept: a 170 km-long city without roads or cars. Everything will be reachable within 5 minutes, and transport will be underground. Designed to host 9 million residents, this may become one of the most valuable real estate zones in the world.

Qiddiya – The Future of Entertainment

Located near Riyadh, Qiddiya will become the entertainment capital of Saudi Arabia, hosting theme parks, sports centers, luxury villas, resorts, Formula 1 tracks, and entertainment events.

Red Sea Project – Luxury Tourism & Hospitality

The Red Sea coastline is being transformed into a tourism paradise with resorts, residential zones, marinas, hotels, and private villas. Early investors are already entering the market.

HIGH-FREQUENCY SEO KEYWORDS TO USE

Use them naturally in your article, ads or metadata:

Saudi Arabia real estate, invest in Saudi Arabia, NEOM investment, property market Saudi Arabia, buy property in Riyadh, foreign ownership Saudi Arabia, real estate Saudi Vision 2030

WHY THIS MATTERS FOR INVESTORS

Saudi Arabia is experiencing a historical investment window. The government is supporting private sector growth, foreign capital, and real estate development by:

Improving property laws for foreigners

Offering investor visas and residency permits

Ensuring government-backed infrastructure

Supporting housing demand with demographics (young population)

The real estate market is developing faster than many analysts expected. Rental yields in central areas range between 8% and 12%, depending on the city and property type. For comparison, many European cities offer only 3% to 4%.

The Kingdom is also experiencing urban population growth, driving demand for:

✔ Apartments and villas

✔ Co-working and office spaces

✔ Commercial real estate

✔ Holiday rentals and Airbnb-style properties

✔ Hotels and tourism-related assets

Saudi Arabia is still early in its transformation. Prices are rising, but compared to Dubai or Qatar, many prime locations are still undervalued — making now the right moment to act.

LIFE IN SAUDI ARABIA – WHAT EXPATS SHOULD KNOW

Living in Saudi Arabia today is much more comfortable than even five years ago. The country now offers:

Modern housing communities

Advanced healthcare systems

International schools and universities

Shopping malls and entertainment districts

Restaurants, cafés, cinemas, concerts

Stable safety and security

English is widely spoken in business areas, and many companies now hire international staff. The local population is young, ambitious and increasingly open to global culture — especially in Riyadh and Jeddah.

THE STRATEGIC ADVANTAGE OF SAUDI ARABIA

Saudi Arabia holds a combination of strengths that very few countries in the world possess. It sits at the crossroads of Asia, Europe, and Africa, and is using this position to evolve into a global hub for trade, real estate, logistics, finance, technology, and tourism.

Key Strategic Strengths of Saudi Arabia:

| Strategic Benefit | Why It Matters for Investors |

|---|---|

| Central geographic location | Global trade hub with access to 3 continents |

| A young and growing population | High demand for housing and jobs |

| Vision 2030 master plan | Guarantees long-term development |

| Investor-friendly government | Incentives, visas, ownership options |

| Undervalued real estate market | Early entry = high capital gains |

| Mega-projects like NEOM & The Line | Create new real estate ecosystems |

| Rising tourism & expat inflow | Drives rental demand and yields |

These advantages shape a rare moment in history — where the market is not yet saturated, prices are still relatively low, but global attention is increasing fast. The smartest investors enter at this exact phase.

TOP CITIES FOR REAL ESTATE INVESTMENT IN SAUDI ARABIA

To understand investment potential, we must examine city-by-city dynamics. Each major city has a distinct economic engine — and a different real estate profile.

RIYADH – THE CAPITAL OF OPPORTUNITY

Riyadh is the economic and political center of Saudi Arabia — a fast-growing metropolis with modern infrastructure, business activity, and international presence. It is the main target for both corporations and government development.

Why Riyadh Is Ideal for Investors

Headquarters of major companies and ministries

High demand for both apartments and villas

Expanding transport and smart-city solutions

Business immigration hub

Long-term rental market stability

Best investment property types in Riyadh

✔ Studio and 1–2 bedroom apartments

✔ Business-class residential units

✔ Co-working and office spaces

✔ Suburban residential compounds

Average ROI in Riyadh:

7% – 10% annually (depending on district and furnishing level)

JEDDAH – THE GATEWAY TO THE RED SEA

Jeddah combines tourism, trade, and coastal lifestyle. It is considered the cultural capital of Saudi Arabia and offers strong potential for short-term rentals and hospitality investments.

Most Promising Districts

Jeddah Corniche

Rawdah District

North Obhur

Beachfront residential zones

Ideal investment strategies

✔ Airbnb-style apartments

✔ Holiday rentals & serviced apartments

✔ Seafront residential units

✔ Commercial properties near tourist zones

Average ROI in Jeddah:

8% – 12% (seasonal tourism boosts returns)

NEOM – THE FUTURE CITY OF THE WORLD

NEOM is not just a city. It is a long-term economic experiment — a vision of how humans could live 50 years from now. With AI-managed infrastructure, renewable energy, autonomous mobility, and high-end housing, NEOM is designed to become a magnet for scientists, tech entrepreneurs, innovators, and wealthy residents.

Key NEOM Districts to Know

| NEOM Zone | Purpose | Investment Potential |

|---|---|---|

| The Line | Futuristic residential city | Very high (long-term) |

| Trojena | Ski resort in desert mountains | Luxury tourism |

| Oxagon | Floating industrial hub | Business & tech |

| Sindalah | Luxury island on Red Sea | High-end hospitality |

NEOM Entry Strategy

| Factor | Risk Level | Reward Level |

|---|---|---|

| Early construction phase | Medium | Very High |

| Long-term ROI expectation | Low | Very High |

| Price appreciation potential | High | Extreme |

| Market visibility | Global | Maximum |

NEOM is one of the few real estate markets in the world where early entry could result in 30–200% recovery potential over 5–8 years, depending on location and infrastructure completion.

DAMMAM – ENERGY, INDUSTRY & STABILITY

Dammam and the Eastern Province represent the industrial and logistics powerhouse of Saudi Arabia. It is less glamorous than Riyadh or NEOM, but it offers long-term stability, consistent demand, and conservative but reliable ROI.

Best Investment Types in Dammam

✔ Worker housing and residential flats

✔ Commercial office spaces

✔ Warehouses and logistics real estate

✔ Serviced apartments near business areas

Best Profile: Investors seeking stable cashflow over high speculation.

THE MOST PROFITABLE PROPERTY TYPES FOR INVESTORS

| Property Type | Best Cities | Risk Level | ROI Range |

|---|---|---|---|

| Studio / 1–2 bedroom units | Riyadh, NEOM | Low | 7–12% |

| Airbnb-style rentals | Jeddah, Red Sea | Medium | 10–18% |

| Land for development | NEOM | Medium | 20%+ |

| Premium villas | Riyadh, Red Sea | Medium | 8–14% |

| Office spaces | Riyadh, Dammam | Low | 6–9% |

| Mixed-use buildings | Riyadh | Medium | 9–13% |

Safest strategy for new investors:

Start with small residential units in growing business districts. Fast rental cycle + low vacancy.

WHY NOW IS THE BEST TIME TO ENTER THE MARKET

The most common mistake investors make is waiting for full completion of mega-projects.

This mindset is dangerous. After completion, the entry barrier becomes too high.

Real estate follows the rule of development economics:

“You don’t invest when everything is ready.

You invest when everything is about to happen.”

Historically, early-stage property investors earn the highest returns. As Vision 2030 continues, property prices are expected to grow steadily over the next 5–10 years.

LIFE & LIFESTYLE IN SAUDI ARABIA – THE MODERN REALITY

Saudi Arabia has changed dramatically. Modern living now includes:

✔ Gated residential communities

✔ Shopping malls & luxury dining

✔ International schools & universities

✔ Festivals & entertainment events

✔ Healthcare at international standards

✔ Cafes, coworking spaces, startups

✔ Western-friendly urban districts

In new zones like NEOM, the lifestyle is designed from scratch — with sustainability, technology, nature, and high comfort integrated into everyday living.

LEGAL OWNERSHIP FOR FOREIGNERS IN SAUDI ARABIA

Saudi Arabia has opened its market to foreign ownership more than ever before. While the process was once extremely limited, Vision 2030 introduced new rules that allow expats, companies, and even individuals to invest in Saudi real estate — with protection of rights.

What Foreigners Can Legally Own

✔ Residential apartments

✔ Villas and townhouses

✔ Hotel-apartments (serviced units)

✔ Commercial property (through company structure)

✔ Land (in specific investment zones)

❌ Not permitted: Properties located in Mecca and Medina — they remain restricted to Saudi nationals.

TYPES OF VISAS FOR INVESTORS

To attract investment, the government launched multiple visa categories, including:

| Visa Type | Duration | Key Benefit | Who It’s For |

|---|---|---|---|

| Premium Residency | 5–10 years | Allows property purchase | High-net-worth individuals |

| Investment Visa | 1–5 years | Business & property investment | Entrepreneurs & investors |

| Real Estate Residency Permit (REIT-based) | Renewable | Linked to investment value | Real estate investors |

| Own Company = Own Property | Ongoing | Corporate ownership | Business owners |

SEO keywords in context:

foreign investors Saudi Arabia, residency through real estate investment, Saudi Premium Residency, Saudi investment visa.

MINIMUM INVESTMENT REQUIREMENTS

The entry barrier depends on the type of investment:

| Strategy | Minimum Capital | Best For | Potential ROI |

|---|---|---|---|

| REIT / Real estate fund | $5,000 | Beginners | 4–7% |

| Buy 1-bedroom apartment | $80,000 – $120,000 | Rental income | 7–12% |

| Start business + real estate | $150,000+ | Residency & income | 8–14% |

| Invest in NEOM land | $250,000+ | Long-term capital growth | 20%+ |

| Luxury property investment | $1M+ | Premium residency | 10–16% |

PURCHASING PROCESS FOR FOREIGNERS

This roadmap illustrates the step-by-step process for buying property legally:

Step-by-Step Buyer’s Guide

Select location and investment strategy

Open a bank account in Saudi Arabia

Apply for investment/residency visa

Work with licensed real estate agent

Verify title deed with Ministry of Justice

Transfer funds via official banking channel

Register ownership under your name or company

Receive digital property certificate

✔ Saudi Arabia uses blockchain-based title registration → this makes property fraud nearly impossible.

TAXES IN SAUDI ARABIA

| Type of Tax | Rate | Applies To |

|---|---|---|

| Personal income tax | 0% | No personal tax |

| Real estate transaction tax | 5% | Paid during purchase |

| VAT | 15% | On services/utilities |

| Corporate tax | 20% | For businesses |

| Capital gains tax | 0% (if holds >3 yrs) | Property resale |

Conclusion:

Saudi Arabia ranks among the most tax-efficient countries for investors worldwide.

COMPARISON WITH OTHER COUNTRIES

Where does Saudi Arabia stand compared to top investment hubs?

| Country | Avg ROI | Tax | Entry Cost | Growth Potential | Stability |

|---|---|---|---|---|---|

| UAE (Dubai) | 6–9% | Moderate | Medium | High | High |

| Turkey | 4–7% | High | Low | Medium | Medium |

| Spain | 3–5% | High | High | Medium | High |

| Saudi Arabia ⭐ | 7–15% | Low | Low to High | Very High | High |

| USA | 5–8% | High | High | Medium | High |

Saudi Arabia beats most competitors in ROI, taxation, long-term demand, and entry options.

GROWTH FORECAST – 2025 TO 2030

Based on current development speed, real estate analysts estimate substantial appreciation over the next few years:

| Year | Expected Avg. Price Growth |

|---|---|

| 2025 | +6% |

| 2026 | +8% |

| 2027 | +10% |

| 2028 | +12% |

| 2029 | +13% |

| 2030 | +15% (mega-projects peak phase) |

➡ If NEOM and The Line succeed → Saudi Arabia may become the next “Singapore of the Middle East.”

GRAPHIC — REAL ESTATE PRICE PROJECTION

(Use as simple infographic or chart in your article)

2025 ████████ 6%

2026 ██████████ 8%

2027 █████████████ 10%

2028 ███████████████ 12%

2029 █████████████████ 13%

2030 ████████████████████ 15%

THE 3 INVESTMENT PROFILES — WHICH ONE ARE YOU?

| Investor Type | Budget | Strategy | Best Location |

|---|---|---|---|

| Explorer | $10K–$50K | REIT funds & fractional ownership | Riyadh & Jeddah |

| Smart Builder | $100K–$300K | Residential rentals | Riyadh business zones |

| Visionary | $500K–$3M | Land + development | NEOM & Red Sea projects |

CALCULATION OF POTENTIAL RETURNS

Let’s take a real example with a 1-bedroom investment in Riyadh:

| Investment Element | Value |

|---|---|

| Purchase Price | $110,000 |

| Furnishing | $7,000 |

| Annual rental income | $12,000 |

| Net profit per year | $10,000 |

| ROI | 9.1% |

| Expected resale after 5 yrs | $150,000+ |

This means:

✔ Passive income

✔ Capital appreciation

✔ Long-term resale potential

✔ Visa + residency options

TOP 5 MISTAKES TO AVOID

❌ Waiting for the market to “fully mature”

❌ Buying without legal verification

❌ Ignoring rental demand data

❌ Expecting fast profit in NEOM

❌ Working with unofficial brokers

Golden rule:

“Invest early, verify everything, and focus on location over hype.”

THE NEW GOLDEN ERA OF INVESTMENT

Saudi Arabia is not a trend. It is a long-term economic strategy backed by trillions of dollars. Vision 2030 is not just a slogan — it is a national transformation blueprint, and real estate is one of its core pillars.

Saudi Arabia is now building the cities of the future — and this creates an opportunity that comes once in a generation.

LIFESTYLE IN SAUDI ARABIA TODAY

Saudi Arabia has transformed dramatically over the last decade. The Kingdom is now a modern hub with luxury living, business opportunities, and international standards of comfort, while still preserving its unique cultural heritage.

Key Lifestyle Features:

Luxury residential communities with modern architecture

Shopping malls, cinemas, and international restaurants

Entertainment options including concerts, sports, and festivals

Healthcare facilities meeting international standards

International schools and universities

Smart city developments like NEOM & The Line integrating technology, eco-living, and AI

The result is a lifestyle that balances work, leisure, and sustainability, appealing to both high-net-worth investors and expatriates seeking quality of life.

EXPAT LIFE IN SAUDI ARABIA

Expats represent a growing portion of residents in major cities such as Riyadh, Jeddah, and Dammam. With Visa reforms and investment programs, life for foreigners is more convenient and legally secure than ever.

Advantages for Expats:

Growing English-speaking environment in business and healthcare

Access to international schools and professional networks

Modern housing compounds with gyms, pools, and coworking spaces

Legal security for property and business investments

Challenges to consider:

Cultural adaptation (gender norms, religious observances)

Limited access to holy cities (Mecca, Medina)

Need for proper sponsorship/visa compliance

Lifestyle balance depending on city choice

Expat communities are growing, offering support networks and modern amenities, making adjustment easier and safer.

BUSINESS CULTURE AND ECONOMIC ENVIRONMENT

Saudi Arabia combines traditional business values with a rapidly modernizing economy. For investors and entrepreneurs:

Business Culture:

Hierarchical decision-making, often involving senior management

Personal relationships and trust are key

Formal meetings and negotiation etiquette matter

Growing tech and startup ecosystem encourages innovation

Investment Opportunities:

Real estate (residential, commercial, hospitality)

Renewable energy projects

Tourism and entertainment (hotels, resorts, leisure facilities)

Tech startups and smart infrastructure

Retail and service sector expansion

Saudi Arabia has corporate tax advantages, investment protection, and government-backed incentives, which make doing business more profitable and secure compared to other Middle Eastern countries.

COST OF LIVING IN SAUDI ARABIA

Understanding daily expenses is critical for both investors and potential residents. While Saudi Arabia offers high income potential, costs vary significantly by city.

Average Monthly Living Costs Table (USD)

| Expense | Riyadh | Jeddah | Dammam | NEOM (estimated) |

|---|---|---|---|---|

| Rent (1-bedroom) | $700–$1,200 | $600–$1,100 | $500–$900 | $900+ |

| Utilities (electricity, water, internet) | $150 | $140 | $130 | $200 |

| Groceries (per person) | $300 | $280 | $250 | $350 |

| Transport (car/fuel) | $120 | $110 | $100 | $150 |

| Dining out (per month) | $150 | $140 | $120 | $200 |

| Health Insurance | $100 | $90 | $85 | $150 |

| Total Average | $1,520 | $1,360 | $1,185 | $2,050 |

Key Takeaways:

Riyadh and NEOM are more expensive but offer higher investment returns and business opportunities

Jeddah provides a coastal lifestyle with lower rents and tourism-driven demand

Dammam is the most stable and affordable for industrial/logistics investors

COMPARISON WITH DUBAI AND OTHER GLOBAL CITIES

To understand Saudi Arabia’s attractiveness, compare it with other popular investment destinations:

| City | Avg ROI | Cost of Living | Tax | Lifestyle Quality | Ease of Foreign Ownership |

|---|---|---|---|---|---|

| Riyadh | 8–10% | Medium | Low | High | Medium–High |

| Jeddah | 8–12% | Medium | Low | High | High |

| NEOM | 15–20% | High | Low | Ultra-High | High |

| Dubai | 6–9% | High | Moderate | High | High |

| London | 3–5% | Very High | High | Very High | Medium |

| Singapore | 4–6% | High | Medium | Very High | Medium |

Observation:

Saudi Arabia offers higher ROI and lower taxes than many global hubs, while the lifestyle is modern and increasingly international.

REAL ESTATE VS DAILY LIVING COSTS

To evaluate profitability, consider net rental yields after living costs. Example for a 1-bedroom investment in Riyadh:

| Element | Amount (USD) |

|---|---|

| Purchase Price | 110,000 |

| Monthly Rent Income | 1,000 |

| Annual Gross Income | 12,000 |

| Annual Utilities/Management | 1,800 |

| Net Income | 10,200 |

| ROI | 9.3% |

| Average Monthly Living Cost (expat) | 1,520 |

| Cashflow after Living | 8,680/year |

Even with moderate living expenses, investors enjoy healthy net returns plus capital appreciation potential.

LIFESTYLE COMPARISON: TRADITIONAL VS MODERN CITIES

| Category | Riyadh / Jeddah | Dammam / Smaller Cities | NEOM / The Line |

|---|---|---|---|

| Modern Housing | High | Medium | Ultra-High |

| Entertainment | High | Medium | Ultra-High |

| International Schools | Available | Limited | Planned |

| Healthcare | Advanced | Moderate | Planned |

| Expat Community | Growing | Small | Small but growing |

| Sustainability & Smart Tech | Developing | Limited | Cutting-edge |

Insight:

Investors seeking long-term property growth should focus on Riyadh, Jeddah, and NEOM, balancing lifestyle, rental demand, and appreciation potential.

LIFESTYLE IMPACT ON INVESTMENT STRATEGY

Lifestyle improvements in Saudi Arabia directly correlate with higher rental demand. For example:

Cities with international schools attract family renters → stable 7–12% rental yields

Coastal cities like Jeddah attract tourists and short-term renters → higher seasonal yields 10–18%

NEOM and The Line attract high-net-worth residents and global professionals → long-term ultra-premium rentals and land value appreciation

Rule of Thumb:

“Lifestyle quality drives real estate demand — better amenities = higher occupancy = stronger returns.”

GRAPHIC IDEA — LIFESTYLE VS ROI CHART

Lifestyle Quality (High → Ultra-High)

NEOM ██████████████

Riyadh ██████████

Jeddah █████████

Dammam ████

Cost of Living (Medium → High)

NEOM ████████

Riyadh ██████

Jeddah █████

Dammam ███

Estimated ROI

NEOM █████████████

Riyadh █████████

Jeddah █████████

Dammam █████

This visual helps investors see trade-offs between lifestyle, cost, and returns.

FUTURE PROSPECTS OF REAL ESTATE IN SAUDI ARABIA

Saudi Arabia is entering a decade of transformation that promises unprecedented growth in real estate, lifestyle, and investment opportunities. Analysts expect:

Key Forecasts 2025–2030:

Residential property prices: +15% overall, with NEOM & Riyadh luxury zones +20–30%

Rental yields: 7–12% in established cities, 15–18% in NEOM & Red Sea tourist areas

Population growth: Young population, increasing urbanization → constant housing demand

Tourism expansion: Over 100 million visitors expected by 2030 → driving hospitality and short-term rentals

Business growth: Tech hubs, renewable energy, entertainment → increasing demand for commercial real estate

Saudi Arabia’s Vision 2030 guarantees government-backed infrastructure investments, which reduce risk and make long-term planning predictable.

RISKS AND HOW TO MITIGATE THEM

Investing in Saudi Arabia is attractive, but it’s not without challenges. Understanding risks ensures smart decision-making.

| Risk Type | Description | Mitigation Strategy |

|---|---|---|

| Regulatory Changes | New rules may affect property ownership | Work with licensed real estate brokers & legal advisors |

| Construction Delays | Mega-projects like NEOM/The Line may lag | Diversify investments across multiple cities & asset types |

| Cultural Adaptation | Certain social norms may impact lifestyle & rentals | Target international compounds & expatriate-friendly districts |

| Market Volatility | Rental demand may fluctuate seasonally | Invest in mixed-use or long-term rental properties |

| Initial Costs | Premium areas require higher capital | Combine mid-range residential with high-end fractional ownership |

Rule of Thumb:

“Risk is minimized when investment is diversified, legally compliant, and aligned with mega-project timelines.”

NEOM AND THE LINE — THE FUTURE OF URBAN LIVING

NEOM and The Line are the most ambitious urban development projects in history, designed to redefine residential and commercial real estate.

The Line Features:

170 km linear city, no cars, no roads, zero carbon footprint

High-speed transit between ends in 20 minutes

Smart homes with AI integration and renewable energy

Projected population: 9 million residents

Luxury residential and commercial zones

Investment Opportunities in NEOM/The Line:

Residential plots in early development stages → high appreciation potential

Luxury villas & high-end apartments → strong rental demand from professionals and tech workers

Commercial hubs → office spaces, coworking, retail stores

Tourism & hospitality → resorts, hotels, eco-tourism experiences

Estimated ROI:

Early residential units: 20–35% in 5–7 years

Commercial hubs: 15–25%

Hospitality projects: 18–30%, depending on tourist influx

Strategic Insight:

Early investors in NEOM and The Line stand to gain the highest long-term returns, but should balance their portfolio with more liquid properties in Riyadh or Jeddah.

LONG-TERM ECONOMIC IMPACT

Mega-projects and Vision 2030 will reshape the Kingdom’s economy, creating long-term stability for investors:

Projected Economic Shifts:

Non-oil GDP contribution rising from 16% → 50% by 2030

Tourism revenue expected to surpass $25 billion per year

Renewable energy sector growth → creating demand for corporate and residential zones nearby

Expat inflow of skilled professionals → consistent demand for premium rental housing

Smart city innovation → rise in AI-managed residential & commercial real estate

These trends suggest Saudi Arabia is entering a “once-in-a-generation” investment window for global real estate players.

INVESTOR STRATEGY ROADMAP

To maximize returns, investors should combine short-term rental income with long-term capital appreciation.

Step 1: Determine Your Profile

| Profile | Capital | Strategy |

|---|---|---|

| Beginner | $10K–$50K | Fractional REITs, rental-focused apartments |

| Moderate | $50K–$200K | 1–2 bedroom apartments, mid-tier residential |

| Advanced | $200K–$1M | Villas, mixed-use, commercial + residential combos |

| Visionary | $1M+ | NEOM/The Line land & luxury developments |

Step 2: Select Cities Based on ROI and Lifestyle

High ROI + Modern Lifestyle → NEOM, Riyadh

Moderate ROI + Coastal Living → Jeddah, Red Sea Projects

Stable, Low Risk → Dammam/Eastern Province

Step 3: Legal Compliance & Visa

Secure investment visa or premium residency

Work with licensed agents and legal advisors

Ensure property registration on blockchain-based system

Step 4: Diversification

Mix short-term rentals, long-term rentals, commercial, and land plots

Balance high-risk/high-return (NEOM) with stable assets (Riyadh/Jeddah)

Step 5: Monitor Market & Exit Strategy

Track Vision 2030 updates

Review rental demand and occupancy quarterly

Consider resale after 5–8 years for capital gain

SUMMARY TABLE — COMBINED CITY & PROJECT ANALYSIS

| City / Project | Entry Cost | Avg ROI | Lifestyle | Risk Level | Notes |

|---|---|---|---|---|---|

| Riyadh | $80K–$200K | 7–10% | High | Low | Best for residential & offices |

| Jeddah | $70K–$180K | 8–12% | High | Medium | Tourism & short-term rentals |

| Dammam | $50K–$120K | 6–8% | Medium | Low | Stable & industrial focus |

| NEOM | $250K+ | 20–35% | Ultra-High | Medium | Early-stage, long-term growth |

| The Line | $300K+ | 25–35% | Ultra-High | Medium | Futuristic, AI-driven, premium |

CONCLUSION — WHY SAUDI ARABIA IS THE FUTURE OF REAL ESTATE INVESTMENT

Saudi Arabia is no longer just an oil-dependent economy. It is a global investment hub with the following advantages:

Vision 2030 is a long-term, government-backed roadmap

Mega-projects like NEOM and The Line are redefining urban living

Foreigners can legally buy property and obtain residency

Rental yields and capital appreciation are among the highest globally

Lifestyle improvements drive sustainable demand

Low taxes and modern infrastructure reduce operational risk

For both investors and expatriates, the Kingdom presents a unique combination of high ROI, lifestyle, and long-term security. The time to enter is now — early entrants stand to benefit from both rental income and exponential property appreciation as Saudi Arabia reaches the peak of its transformative decade.

FINAL INVESTOR CHECKLIST

✔ Determine budget and risk tolerance

✔ Select cities/projects based on ROI and lifestyle

✔ Secure legal ownership and visa compliance

✔ Diversify investments across residential, commercial, and land

✔ Track mega-project timelines and Vision 2030 progress

✔ Balance short-term rental income with long-term capital gains

FEATURED SNIPPET READY KEY POINTS

“Saudi Arabia real estate offers 7–35% ROI depending on city and asset type.”

“Foreign investors can legally buy property, obtain residency, and invest in NEOM or The Line.”

“Mega-projects and Vision 2030 guarantee infrastructure, growth, and urbanization for long-term stability.”

“Riyadh, Jeddah, Dammam, NEOM, and Red Sea projects are top investment hotspots.”