How to Start Investing in Real Estate with Little Capital

August 14, 2025

Introduction

Investing in real estate is often seen as a pathway to financial freedom and wealth building. Yet, many aspiring investors believe they need large sums of money to get started. The truth is, real estate investing with little capital is not only possible but increasingly accessible, thanks to modern tools, financial products, and creative strategies.

Whether you want to generate passive income, grow equity, or flip properties, starting small can be your first step to long-term financial success. This guide is a comprehensive roadmap for anyone ready to invest in property with limited funds, with global relevance and strategies adaptable to various markets.

Table of contents for the article

ToggleUnderstanding Real Estate Investment Basics

Real estate is a diverse asset class that allows you to earn money through ownership, rental income, and appreciation. Understanding the basics is crucial for small-capital investors to make informed decisions.

What is Real Estate Investment?

Real estate investment can include:

Residential Properties: Single-family homes, duplexes, and condos.

Commercial Properties: Office buildings, retail spaces, warehouses.

REITs (Real Estate Investment Trusts): Stocks representing real estate portfolios.

Crowdfunding Projects: Collective investments in large properties.

The goal is either cash flow, capital appreciation, or both, and your chosen strategy will depend on your capital, risk tolerance, and investment horizon.

Types of Real Estate Investments

Residential Properties

Residential real estate is ideal for beginners due to smaller entry costs. Rental income can cover mortgages, and property appreciation can increase your wealth.

Example: A small condo bought for $50,000 in a growing city could generate $500/month in rent. Over five years, rental income plus property appreciation can yield a 30–40% return.

Pros:

Lower initial capital needed

Easier to finance

High rental demand

Cons:

Requires property management

Potential vacancies

Maintenance costs

Commercial Properties

Commercial investments include office buildings, retail shops, and warehouses. They often require larger investments but offer long-term leases and higher rental yields.

Pros:

Higher income potential

Long-term tenants reduce turnover risk

Cons:

Complex management

Market cycles more pronounced

REITs (Real Estate Investment Trusts)

REITs are publicly traded or private funds owning income-generating properties. They allow investors to buy shares with minimal capital, sometimes under $500.

Pros:

Low entry barrier

Diversified portfolios

Liquid (can sell shares anytime)

Cons:

Limited control over properties

Market-dependent returns

Real Estate Crowdfunding

Crowdfunding platforms allow small investors to participate in large-scale projects. This method is ideal for those who cannot buy properties outright.

Example Platforms: Fundrise, RealtyMogul, CrowdStreet.

Pros:

Low minimum investment

Access to commercial and residential projects

Passive income

Cons:

Less liquidity than REITs

Platform fees

Market risks

Comparison of Real Estate Investment Strategies for Small Capital

| Strategy | Minimum Capital | Expected ROI* | Risk Level | Hands-on Required | Global Accessibility |

|---|---|---|---|---|---|

| REITs | $500 | 6–10% | Low | Low | High |

| Crowdfunding | $500–$1,000 | 8–15% | Medium | Low | Medium-High |

| House Hacking | $5,000+ | 10–20% | Medium | Medium-High | Medium |

| Short-Term Rentals | $10,000+ | 12–25% | Medium-High | High | Medium-High |

| Renovation & Flipping | $10,000+ | 20–40% | High | High | Medium |

| Partnerships & JV | $1,000+ | 15–30% | Medium | Medium | Medium |

*ROI: Return on Investment (annualized estimate)

Step-by-Step Checklist for Small-Capital Real Estate Investors

Set Investment Goals

Define short-term and long-term objectives (cash flow, appreciation, or flipping).

Evaluate Available Capital

Determine how much you can invest without financial strain.

Select Investment Strategy

Choose REITs, crowdfunding, house hacking, or other methods based on your capital and risk tolerance.

Research Markets

Study local and international opportunities, economic trends, rental demand, and property appreciation.

Analyze Properties or Projects

Calculate potential ROI, rental income, and expenses.

Secure Financing

Explore mortgages, seller financing, microloans, or leverage partnerships.

Invest and Monitor

Begin small, track performance, and adjust strategies as needed.

Reinvest Profits

Gradually scale your portfolio to maximize wealth creation.

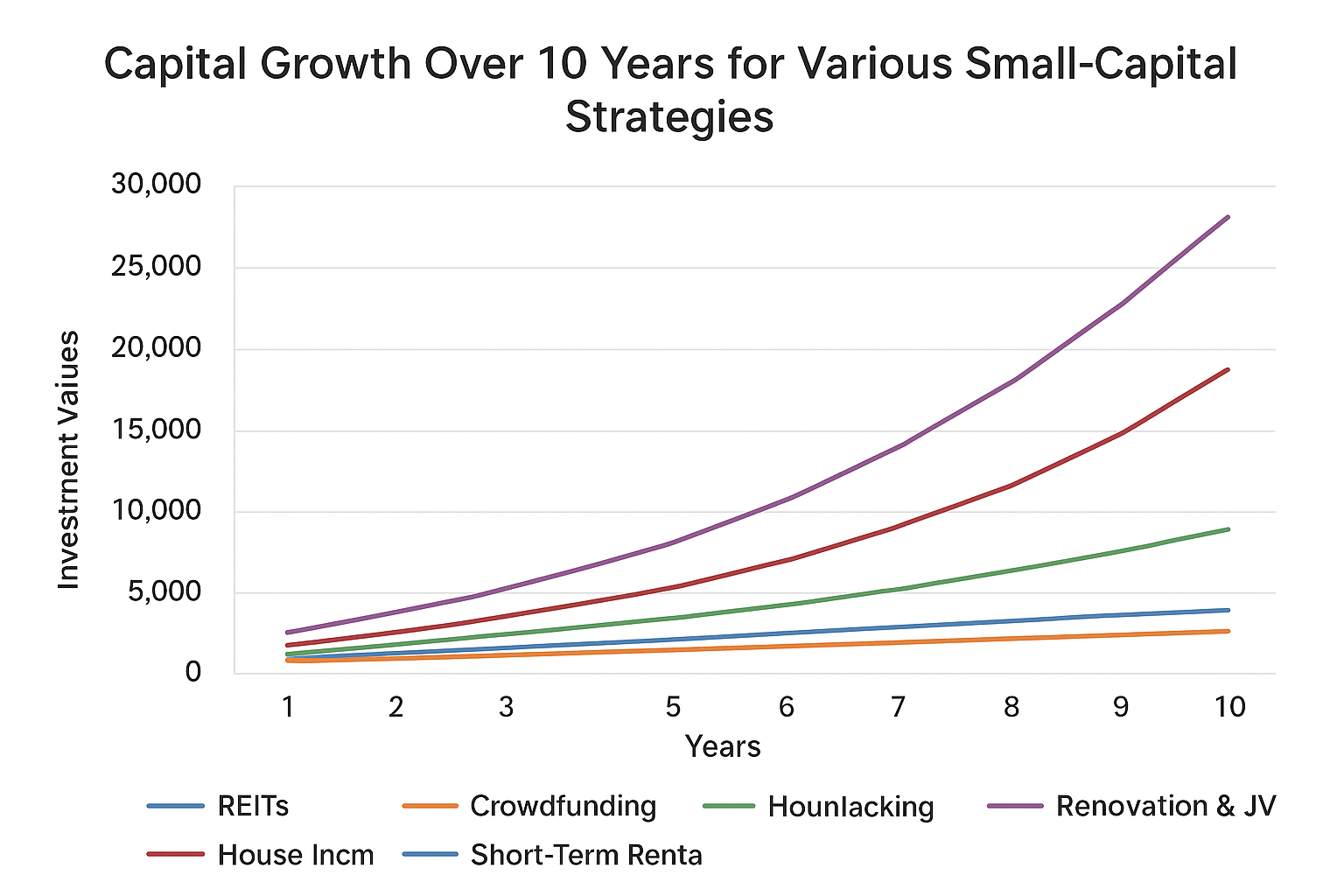

Example ROI Growth Graph for Small-Capital Investments

(Visual Description for Website or Blog)

X-axis: Years (1–10)

Y-axis: Investment Value ($)

Lines:

REITs: Moderate steady growth

Crowdfunding: Moderate with occasional spikes

House Hacking: Slower first 2 years, then accelerating with rental income and equity

Flipping: High spikes, irregular

This graph visually demonstrates how small investments can grow over time across different strategies.

Why Start Investing with Small Capital

Starting small is not just practical — it’s strategically advantageous.

Benefits of Early Investment

Time Leverage: Early investments benefit from compound growth. Even modest returns accumulate significantly over decades.

Practical Experience: Learning property management, market evaluation, and negotiation early reduces mistakes later.

Portfolio Diversification: Small investments allow you to spread risk across multiple assets, rather than concentrating all capital in one property.

Common Myths About Real Estate Investing

Myth 1: You need large capital.

Reality: REITs, crowdfunding, and partnerships enable investing with a few hundred dollars.

Myth 2: Real estate is only for experts.

Reality: Knowledge and mentorship can bridge experience gaps.

Myth 3: You must manage properties yourself.

Reality: Property management companies or passive investment vehicles reduce hands-on involvement.

Real-World Example: Growing Small Capital in Real Estate (5–10 Years)

| Initial Investment | Strategy | Year 1 ROI | Year 5 ROI | Year 10 ROI | Notes |

|---|---|---|---|---|---|

| $500 | REITs | $30 | $180 | $600 | Dividends reinvested annually |

| $1,000 | Crowdfunding | $80 | $600 | $1,500 | Average 12% annual return, reinvested |

| $5,000 | House Hacking | $600 | $3,500 | $8,000 | Rental income + property appreciation |

| $10,000 | Short-Term Rentals | $1,200 | $7,500 | $18,000 | Airbnb rental income, moderate occupancy |

| $10,000 | Renovation & Flipping | $2,000 | $10,000 | $25,000 | Flipping 1–2 properties per year, market dependent |

| $1,000 | Partnership / JV | $150 | $1,200 | $3,000 | Profits distributed, depends on deal quality |

Assumptions:

All returns reinvested where possible

Rental income net of expenses

Property appreciation included for House Hacking and Flipping

Market conditions moderately positive

Key Takeaways:

Even $500 in REITs can grow significantly over 10 years with compounding.

House Hacking and Short-Term Rentals scale faster once property equity and rental income accumulate.

Flipping can deliver high returns but carries more risk.

Partnerships allow entry into deals with minimal personal capital.

Strategies to Invest with Limited Funds

House Hacking

House hacking is one of the most accessible methods to start with limited capital.

Definition: Buying a property, living in part of it, and renting out other units to cover costs.

Example:

Buy a duplex for $120,000

Live in one unit

Rent the other for $800/month

Mortgage covered, plus equity growth, with minimal personal investment.

Real Estate Crowdfunding Platforms

Crowdfunding allows co-investing with others, often with minimal capital ($500–$1,000). Projects range from residential renovations to commercial developments.

Advantages:

Diversification

Lower risk exposure

Access to global markets

Disadvantages:

Less control over property decisions

Returns subject to market performance

REITs

REITs let investors participate in large-scale property investments without direct ownership. Some offer dividends monthly or quarterly, ideal for passive income.

Partnerships and Joint Ventures

Pooling resources with other investors allows entry into larger deals.

Tips for success:

Draft clear agreements

Define roles and profit sharing

Ensure transparency

Seller Financing and Lease Options

Seller Financing: Purchase directly from the seller, who provides the mortgage. Minimal upfront capital needed.

Lease Options: Rent with the option to buy later, applying rent toward purchase. Flexible for cash-strapped investors.

Financing Options for Small Investors

Traditional Mortgages vs. Alternative Financing

Traditional mortgages may require 20% down, often unfeasible for small investors.

Alternative financing:

Microloans

Peer-to-peer lending

Hard money loans (short-term, higher interest, for renovation projects)

Government Grants and Incentives

Many countries offer first-time buyer incentives, tax deductions, or grants.

Example:

US: FHA loans with 3.5% down

UK: Help to Buy scheme

Canada: First-Time Home Buyer Incentive

Leveraging Credit Wisely

Credit can supplement small capital but must be used cautiously. Avoid overleveraging to prevent financial strain.

Finding the Right Properties

Market Research Tips

Check historical appreciation trends

Analyze supply and demand for rentals

Evaluate economic growth of neighborhoods

Neighborhood Analysis

Invest in areas with:

Strong employment growth

Good schools and amenities

Planned infrastructure projects

Evaluating Property Potential

Look for:

Properties needing cosmetic fixes

Multi-family units

Proximity to transport and commerce

Risk Management and Common Pitfalls

Understanding Market Fluctuations

Property values can decline during recessions. Diversifying and starting small mitigates losses.

Avoiding Overleveraging

Invest within your financial means. Ensure rental income or other sources can cover debts.

Legal and Tax Considerations

Understand local property laws

Factor in insurance and property taxes

Keep records for tax deductions

Tips to Grow Your Real Estate Portfolio

Reinvest profits into new properties

Expand gradually to larger or multiple properties

Network with experienced investors and mentors

Stay updated with market trends

Real-Life Success Stories

Case Study 1: John’s $5,000 Start

Invested $5,000 in REITs. Within five years, profits and partnerships enabled purchase of two rental properties, demonstrating how small capital can scale.

Case Study 2: Maria’s Crowdfunding Win

Invested $1,000 via a crowdfunding platform. Three years later, the investment grew by 40%, showing global accessibility of small-cap investments.

Advanced Strategies for Ambitious Investors

Renovation and Flipping on a Budget

Focus on cosmetic upgrades rather than structural changes

Partner with skilled contractors to minimize costs

Flip in high-demand areas

Short-Term Rentals

Platforms like Airbnb allow high rental income even with smaller properties. Manage risks by:

Checking local regulations

Ensuring property insurance

Monitoring occupancy trends

Tax Optimization

Use deductions for mortgage interest, repairs, and property management

Leverage depreciation benefits

Consult a tax professional for international considerations

FAQs About Investing in Real Estate with Small Capital

Can I start with $500? Yes, via REITs or crowdfunding.

Do I need experience? Knowledge plus mentorship often suffices.

How soon will I see returns? Rental income is immediate; appreciation takes years.

Is house hacking legal worldwide? Mostly yes, but check local regulations.

Can I invest globally? Crowdfunding and REITs allow international diversification.

Are short-term rentals profitable? Can be, but depend on location and regulations.

What’s the risk of crowdfunding? Market-dependent; platforms may charge fees.

Should I hire a property manager? For convenience, yes; it reduces stress.

What financing options exist for small investors? Microloans, seller financing, FHA loans, and REITs.

Is flipping risky? Yes, requires market knowledge and cost control.

How can I scale gradually? Reinvest profits and build partnerships.

Are REITs better than physical properties? Depends on liquidity, control, and capital.

Can I invest in commercial property with little capital? Only via crowdfunding or partnerships.

Is real estate recession-proof? No, but it can be resilient with long-term planning.

How do I start globally? Platforms like Fundrise, RealtyMogul, and international REITs help.

Conclusion and Action Plan

Investing in real estate with little capital is entirely achievable. By choosing the right strategies, leveraging modern tools, and learning continuously, small investors can:

Generate passive income

Build equity and appreciation

Scale a real estate portfolio gradually

Action Steps:

Decide your preferred investment type: REITs, crowdfunding, or house hacking.

Research local and global opportunities.

Start small, invest strategically, and reinvest profits.

Network with mentors and experienced investors.

Monitor performance, adjust strategies, and scale.

Real estate is no longer exclusive to the wealthy. Smart, small-capital investors can create lasting wealth globally.