Minimal Entry With $50k — Where You Can Actually Invest in Real Estate

December 3, 2025

Understanding Why $50,000 Is a Strategic Entry Point

A $50,000 starting capital opens the door to a wide range of real estate investment opportunities that would otherwise be inaccessible to small retail investors. While $10k or even $20k typically limits the investor to indirect exposure or high-risk deals, $50k provides both leverage and diversification potential. With this amount, one can enter structured real estate funds, fractional ownership platforms, private rental deals, and even certain commercial real estate segments.

Table of contents for the article

ToggleMore importantly, $50k is considered the “sweet spot” for blending long-term appreciation with passive income. It’s enough to buy shares in professionally managed assets, participate in value-add projects, and secure positions in high-growth regions where property demand continues to rise. This capital level also allows investors to avoid overexposure to a single property while still benefiting from meaningful compounding.

At the same time, the real estate market of 2025 is not the same market it was five or ten years ago. Digitization, tokenization, real estate crowdfunding, and new hybrid financial models have made property investment more liquid and more accessible than ever before. A modern investor can move from passive to semi-passive and even active strategies without needing millions. The key is choosing the right path.

Core Approaches to Investing $50k in Real Estate

Before diving into specific vehicles, it’s essential to understand the broader strategic options available. Real estate investment today can be categorized into three primary approaches: direct ownership, fractional ownership, and financialized real estate products. Each path has distinct advantages, time commitments, and risk levels.

Direct Ownership

Direct ownership involves purchasing physical property or participating in joint ownership of a tangible asset. While $50k may not be enough to purchase a prime property outright, it does provide a sufficient foundation for down payments, renovation projects, and strategic partnerships.

This approach gives investors the highest level of control and long-term equity potential. However, it also requires more involvement, risk assessment, and awareness of local market dynamics. For investors willing to put effort into property management or value-add improvements, direct ownership can generate substantial returns.

Fractional or Shared Ownership

Fractional ownership has become one of the fastest-growing segments in modern real estate investment. It allows individuals to purchase partial ownership of residential or commercial real estate, earning proportional rental income and benefiting from appreciation.

This model is ideal for investors with $50k because it provides access to high-quality assets—often in top-tier markets—without requiring a massive upfront investment. Fractional platforms usually handle property management, tenant relations, and maintenance, making the experience relatively passive.

Financialized Real Estate Products

Financialized real estate refers to investment products like REITs, private real estate funds, tokenized real estate assets, and notes backed by property. These products offer high liquidity, professional management, and risk diversification.

For investors who prefer a hands-off approach while still enjoying exposure to the real estate sector, financialized products are often the first choice. With $50k, one can create a well-balanced portfolio across multiple funds or sectors such as industrial, multifamily, hospitality, and medical real estate.

Best Real Estate Investment Options Starting at $50k

Rental Property Down Payments

One of the most common and profitable uses for $50k is a down payment on a residential rental property. Whether it’s a single-family home, condominium, or duplex, the strategy is straightforward: leverage the initial capital to secure a mortgage, rent the property, and build equity over time.

The strength of this strategy lies in the combination of rental income and property appreciation. Well-chosen rental properties can generate steady monthly cash flow that offsets mortgage payments while the market value rises year after year.

However, success depends heavily on market research. Factors like job growth, population migration, rental demand, crime rates, and local regulations can significantly impact returns. Investors should also consider whether they prefer long-term rentals, short-term rentals (such as vacation properties), or mid-term rentals targeted at traveling professionals.

Turnkey Real Estate Investments

Turnkey properties are fully renovated, tenant-ready homes provided by specialized companies. These companies handle acquisition, renovation, tenant placement, and sometimes long-term property management. For an investor with $50k, this is an excellent option for generating passive rental income with minimal involvement.

Turnkey properties allow investors to purchase rental homes in high-yield markets without ever visiting the location. Many such markets—often in the Midwest or Southeast—offer strong returns due to lower acquisition costs and rising population inflows.

The downside is that turnkey properties can sometimes come with inflated prices, so due diligence is essential. Still, investors who choose reputable companies can achieve reliable and predictable income streams.

Real Estate Syndications

Real estate syndication is a powerful way to invest $50k into large-scale commercial properties. In a syndication, multiple investors pool their capital to fund acquisitions such as apartment complexes, office buildings, industrial warehouses, or retail centers.

Syndications are usually managed by professional operators who oversee everything from asset acquisition to renovation and performance optimization. Investors participate as limited partners and receive passive income from rental operations, along with a share of the profits once the asset is sold.

For investors seeking exposure to institutional-grade real estate without becoming landlords, syndications offer one of the best paths. The typical minimum investment ranges from $25k to $50k, making your capital sufficient to enter.

Real Estate Crowdfunding Platforms

Crowdfunding platforms revolutionized real estate investing by allowing small and mid-size investors to participate in deals that used to be accessible only to institutional players. With $50k, one can diversify across multiple property types, markets, and risk levels.

These platforms offer several types of investments:

Equity deals — participation in property ownership and profit sharing

Debt deals — providing loans secured by property and receiving interest

Hybrid models — combining elements of both

Platforms often categorize deals by risk level, time horizon, and expected returns, which helps investors structure their portfolio intelligently.

One of the major benefits is transparency: platforms usually provide detailed data, expected cash flow, financial models, and market analyses.

Private REITs and Public REITs

Real Estate Investment Trusts (REITs) are among the most accessible real estate investment vehicles. They offer high liquidity, steady dividends, and exposure to diverse property sectors such as industrial, multifamily, office, logistics, data centers, and healthcare.

With $50k, an investor can create a diversified REIT portfolio or choose high-performance niches like:

Warehouse and logistics REITs

Residential multifamily REITs

Hospitality and resort REITs

Healthcare and senior living REITs

Self-storage REITs

Data center REITs

Public REITs trade like stocks, making it easy to enter and exit positions. Private REITs, on the other hand, often provide higher returns but come with liquidity restrictions. For long-term investors, private REITs can be a strong option due to their stable income and lower volatility.

Exploring Advanced Real Estate Strategies for a $50k Entry

After understanding the foundational vehicles such as rental properties, REITs, crowdfunding platforms, and syndications, it becomes important for investors to explore deeper, more sophisticated strategies available at the $50,000 capital level. Real estate is not a monolithic market; it is a complex ecosystem composed of micro-niches, evolving regulatory landscapes, demographic cycles, and emerging technological frameworks. All these elements create pathways for investors who are ready to look beyond traditional approaches.

The shift toward remote work, population migration to secondary cities, and the increasing demand for specialized property types all influence where and how modern investors deploy capital. With $50k, you can begin participating in investment segments that used to be reserved for seasoned professionals. These strategies often provide improved yield potential, better risk-adjusted returns, or unique market opportunities unavailable in standard residential investing.

Emerging Regional Opportunities for $50k Real Estate Investors

Real estate markets today are deeply shaped by migration flows and economic transformations. Investors with $50k can leverage these shifts to target regions with high growth and favorable long-term fundamentals. Instead of focusing solely on major metropolitan centers, many experienced investors now consider secondary and tertiary cities where affordability remains intact, and demographic inflows create strong housing demand.

These regional shifts are influenced by job relocation, rising costs in traditional markets, and the expansion of technology hubs into previously overlooked areas. As workforce distribution changes and people seek more space, stability, and affordability, certain regions are experiencing consistent upward pressure on rent and home values. Investors who enter early can benefit from substantial appreciation driven by these large-scale macroeconomic changes.

Population movement also reshapes the rental landscape. Areas with increasing numbers of young professionals, remote workers, or aging populations create distinct opportunities. Young professionals may drive demand for modern apartments close to amenities. Remote workers may push demand toward suburban or semi-rural homes with more space. Aging populations may increase demand for properties suited to long-term tenancy and accessible living. All these dynamics influence property values and rental stability.

For investors deploying $50k, aligning capital with regions showing strong economic indicators, steady population growth, and supply scarcity can significantly enhance long-term returns. Such markets often outperform broader national averages, making them ideal for strategic real estate expansion.

Value-Add Real Estate Strategies for Mid-Level Investors

Value-add strategies involve improving a property to increase its income potential and market value. Even though full-scale renovations may require larger budgets, a $50k investment can still be strategically applied within a larger partnership or through fractional participation in a value-add fund. The core idea behind value-add real estate is to identify underperforming assets and enhance them through targeted upgrades that attract better tenants, raise rental rates, and generate higher overall valuation.

These projects may focus on improving interior quality, enhancing exterior appeal, modernizing building systems, or repositioning the property to attract a different demographic. As properties undergo transformation, investors benefit from both increased cash flow and appreciation. With $50k, participating in value-add projects becomes accessible through platforms specializing in such renovations or through private partnerships where multiple investors collectively fund improvements.

Investors appreciate value-add strategies because they provide a middle ground between stable, low-yield investments and high-risk speculative projects. Value-add properties generate income during renovation, making them less volatile, yet their upside potential remains significant. For long-term investors focused on compounding returns, this approach often offers a balance of predictability and growth that aligns well with the goals associated with a $50k entry.

Debt-Based Real Estate Investments and Interest-Driven Returns

Investing in debt-backed real estate products is another avenue accessible to investors with $50k. These involve lending capital to developers, property owners, or project sponsors in exchange for fixed interest payments. Unlike equity investments, where returns depend on rental performance or asset appreciation, debt investments create predictable and contractually defined income streams.

Real estate notes, hard money lending, and secured debt offerings are typical examples of this investment type. They are appealing because they prioritize capital protection. Debt holders are paid before equity holders, which means downside risk is generally lower. For investors who value security and steady cash flow, debt-based real estate can be an excellent component of a diversified strategy.

With $50k, a debt investor can participate in professionally managed lending programs where funds are allocated across multiple loans to reduce exposure to any single borrower. These programs often include strict underwriting processes, collateral-backed security, and predefined term lengths. Although the growth potential is lower compared to equity-based investments, the stability and predictability of returns offer a valuable counterbalance within a larger portfolio. Many investors appreciate having a portion of their capital in fixed-income real estate products that generate regular interest without the volatility associated with property ownership.

Short-Term Rental Investments Powered by Market Demand

Short-term rental markets have undergone immense transformation, driven by global travel trends, remote work adoption, and the growth of home-sharing platforms. A $50k investment can serve as an entry point into this sector through fractional ownership, partnerships, or down payments on properties specifically optimized for short-term stays.

Short-term rentals often generate higher monthly income compared to long-term rentals, especially in regions with strong tourism or seasonal demand. These properties attract travelers seeking unique experiences, families needing temporary housing, and digital nomads looking for extended stays. The income potential can be substantial, with dynamic pricing models adjusting nightly rates based on demand.

The key challenge in short-term rentals lies in management intensity and regulatory variations. However, modern property management services simplify the process by handling cleaning, guest communication, bookings, and local compliance. Investors using $50k can rely on these services to achieve passive exposure to the short-term rental market while enjoying high yield potential.

This segment also benefits from diversification. By choosing locations with both tourism demand and strong local economic activity, investors reduce the risk associated with seasonal slowdowns. As travel patterns evolve and remote work continues shaping long-term rental preferences, short-term rental assets remain a promising avenue for investors focused on maximizing income potential.

Tokenized Real Estate and Digital Property Shares

Tokenization represents one of the most innovative developments in modern real estate investing. It involves converting property ownership into digital tokens stored on secure blockchain networks. This technology allows investors to purchase small fractions of high-value properties with minimal capital requirements while enjoying the benefits of liquidity that traditional real estate lacks.

A $50k investment provides significant flexibility within tokenized real estate ecosystems. Investors can distribute capital across multiple properties, diversify geographically, and participate in professionally managed assets without long-term lock-up periods. The accessibility of tokenized real estate attracts both new investors and seasoned professionals seeking modern, data-driven ways to expand their portfolios.

Tokenized assets combine the stability of real estate with the transactional efficiency of blockchain. Investors receive rental distributions, appreciation gains, or profit shares depending on the structure of the offering. Transparency is enhanced through immutable records, and compliance frameworks continue to evolve to support secure participation.

As financial institutions explore blockchain-based asset infrastructure, tokenization is positioned to become a mainstream investment pathway. Investors who allocate $50k into this sector gain early exposure to a transformative trend that is reshaping global property markets.

Building a Diversified Real Estate Portfolio With $50k

As real estate evolves into a multi-layered ecosystem of physical and digital assets, diversification becomes one of the most critical principles for long-term success. With $50k, diversification is entirely achievable, even without buying multiple physical properties. Modern platforms, financialized products, and shared-ownership models make it possible to construct a well-balanced portfolio without excessive capital concentration or operational burden.

Diversification in real estate does not simply mean spreading money across different locations. It requires distributing capital across property types, risk tiers, income models, and investment structures. An investor with $50k can create a thoughtful blend of stable cash-flow assets, value-add opportunities, debt-backed instruments, and long-term appreciation plays. This balanced allocation protects against volatility while positioning the portfolio to capture steady growth over time.

Diversification also prevents overexposure to a single economic cycle. Certain property niches thrive during expansion phases, while others gain strength during downturns. By combining strategies, investors can create resilience and reduce the impact of market fluctuations.

Balancing Risk Levels Across Different Real Estate Paths

A critical step in maximizing the potential of a $50k investment is understanding how to allocate capital by risk category. Each type of real estate investment carries specific risk dynamics, which can be managed through smart positioning. Investors who approach the market with a structured risk framework often outperform those who rely solely on intuition.

Risk varies depending on the project, management quality, location, and investment vehicle. Stable rental properties carry predictable income but slower appreciation. Value-add or repositioning projects often promise higher upside but require tolerance for renovation unpredictability. Debt-backed real estate reduces volatility yet delivers fixed returns. Tokenized real estate introduces technological advantages but depends on emerging market adoption. Short-term rentals offer remarkable yield potential yet depend on demand cycles and regulatory stability.

Segmenting risk allows investors to combine long-term stability with strategic growth. A portfolio that mixes moderate and high-yield opportunities often achieves better overall performance than one focused exclusively on either conservative or aggressive strategies. Smart investors allocate capital with intention, prioritizing long-term resilience and sustainable cash flow.

Long-Term Perspective and Compounding Power in Real Estate

Real estate rewards patience. Even with a modest $50k entry, adopting a long-term mindset magnifies returns dramatically through the power of compounding. Real estate compounding occurs when rental income, appreciation, and reinvested profits build on each other over many years. It transforms an initial investment into a significantly larger asset base.

Long-term investors benefit from gradual but consistent value growth driven by inflation, population expansion, and rising land scarcity. Rental income grows naturally as costs adjust over time. Properties that initially produce modest returns often deliver substantial wealth after several years of sustained growth. Reinvesting profits into additional real estate opportunities accelerates the process and expands the investor’s exposure to the market.

The long-term horizon also smooths out cyclical fluctuations. Property markets can experience temporary downturns, but values tend to recover and surpass previous peaks as economic fundamentals strengthen. Investors who maintain discipline and hold through cycles typically achieve strong outcomes. With $50k as a starting point, a multi-decade real estate plan can evolve into a diversified portfolio of rentals, equity shares, debt instruments, and digital assets.

Understanding Market Cycles and Timing Strategies

Market cycles are a defining aspect of real estate performance. The property market moves through phases of expansion, equilibrium, contraction, and recovery. Recognizing these cycles helps investors make informed decisions and avoid common mistakes. While timing the market perfectly is impossible, understanding cycles supports strategic positioning.

During expansion phases, rental demand is high, property values rise, and construction activity intensifies. This environment benefits value-add projects and new developments, where appreciation potential is strongest. In contrast, contraction periods often create opportunities for purchasing undervalued properties, distressed assets, or off-market deals at favorable prices.

Cycle awareness also informs risk management. Conservative investments, such as debt-backed real estate or stable multifamily assets, perform well in uncertain environments. Aggressive growth strategies flourish in early expansion periods when recovery is underway. Investors with $50k can allocate capital based on cycle positioning, enhancing returns while reducing unnecessary exposure.

Real estate cycles vary regionally, meaning that understanding local economic conditions is just as important as recognizing national trends. By following employment data, migration shifts, and regional development plans, investors can identify emerging opportunities before they become mainstream.

Real Estate as an Inflation Hedge for $50k Investors

One of the strongest arguments for entering real estate with $50k is its natural ability to hedge against inflation. As the cost of living rises, property values and rental rates tend to follow. Real estate is anchored in physical land and structures, which become more valuable as construction costs and material prices increase. This makes property holdings inherently resistant to inflation-driven erosion.

Rental income provides ongoing protection. Landlords can adjust rents in accordance with market conditions, ensuring steady income growth over time. This adaptability is particularly valuable during periods of economic pressure when traditional financial assets may lose purchasing power.

Debt-financed investments also benefit from inflation. When investors purchase properties using leverage, the real cost of the loan decreases as inflation rises. Meanwhile, the property itself appreciates, creating a widening gap between asset value and debt obligation. Even without purchasing property outright, participating in inflation-resistant real estate funds or fractional ownership platforms allows investors with $50k to take advantage of the inflation hedge effect.

Passive Versus Active Real Estate Strategies

Investors deploying $50k can choose between passive and active approaches depending on their goals, time availability, and experience. Each path has its benefits and challenges, and many investors ultimately combine both to achieve maximum flexibility.

Active real estate investing involves hands-on engagement. This may include analyzing markets, overseeing renovations, managing tenants, or participating directly in property operations. Active strategies offer high upside because investors can influence property performance through decision-making and improvements. However, they require time, skill, and comfort with operational responsibility.

Passive investing eliminates day-to-day involvement. Platforms, syndicators, managers, or funds handle all aspects of property operations. Passive investors enjoy cash flow and appreciation without operational stress. With $50k, passive strategies are highly accessible through REITs, crowdfunding deals, and fractional ownership. These vehicles provide exposure to high-quality assets without requiring direct management.

The best approach depends on the investor’s personality and objectives. Some prefer the control and customization of active strategies. Others prioritize simplicity and consistency. A blended approach may involve using a portion of the $50k for passive income and another portion for active opportunities with higher growth potential.

The Psychological Aspect of Real Estate Investing

Beyond numbers and strategies, psychology plays a crucial role in real estate investing. A $50k entry requires confidence, patience, discipline, and willingness to learn. Investors who succeed understand that real estate is rarely a quick-profit endeavor. Instead, it rewards those who adopt a calm, forward-thinking mindset.

Fear of market fluctuations, hesitation to commit capital, and emotional decision-making can undermine even the most promising strategies. Real estate markets move more slowly than stock markets, making it essential for investors to avoid reacting impulsively to short-term changes. Successful investors rely on analysis, long-term planning, and adaptability rather than emotion.

Confidence is built through research, knowledge, and diversified positioning. As investors grow familiar with the market, they learn to trust the process and stay committed to their goals. A $50k investment, when managed with clarity and psychological steadiness, becomes the foundation for substantial long-term wealth.

Scaling a Real Estate Portfolio Starting From $50k

Scaling a real estate portfolio from an initial $50k investment requires a combination of reinvestment, strategic leverage, intelligent market timing, and consistent risk management. The first investment acts as the foundation, but long-term growth depends on how effectively an investor multiplies that initial position.

A $50k starting point is enough to begin generating recurring income, and those cash flows eventually become fuel for new acquisitions. Over time, reinvesting returns accelerates portfolio expansion and reduces reliance on personal capital.

Here is a simplified illustration of portfolio scaling with consistent reinvestment:

| Year | Starting Capital | Annual Return | Reinvested Profit | Total Portfolio Value |

|---|---|---|---|---|

| 1 | $50,000 | 10% | $5,000 | $55,000 |

| 3 | $55,000 | 10% | $6,050 | $61,050 |

| 5 | $61,050 | 10% | $6,705 | $67,755 |

| 10 | $67,755 | 10% | $10,920 | $99,205 |

Even without adding new money, a disciplined reinvestment strategy transforms a modest start into a substantial long-term holding.

Below is a visual representation of how a real estate asset can appreciate over 10 years:

Real Estate Appreciation Chart:

(Generated for this article)

And here’s how rental income may grow over the same period:

Rental Income Growth Chart:

These charts demonstrate the power of compounding in a stable real estate environment.

Using Examples to Understand Scaling

To better understand how $50k can evolve, consider a simplified scenario of reinvesting returns:

Example:

An investor buys fractional ownership in a multifamily asset using $50k. The property provides 8% annual cash flow plus 3% appreciation. Instead of withdrawing returns, the investor reinvests them into additional shares or new projects each year. Within a decade, the investment grows organically into a significantly larger position due to constant compounding and diversification.

This example illustrates how real estate behaves like a slow but powerful engine that accelerates over time.

Leveraging Equity to Expand the Portfolio

Equity leverage is one of the most powerful tools real estate investors use when building long-term wealth. When a property increases in value, the new equity can be refinanced or borrowed against to fund additional acquisitions — without selling the asset.

Table: Simplified Leverage Scenario

| Property Value | Loan Balance | New Equity | Reinvested Into |

|---|---|---|---|

| $200,000 | $150,000 | $50,000 | Second Property |

| $230,000 | $145,000 | $85,000 | Third Investment |

| $260,000 | $140,000 | $120,000 | Larger Assets |

This technique allows portfolios to grow rapidly while assets continue generating income.

Example:

An investor who uses $50k to secure a down payment on a rental home can, after several years of appreciation and mortgage reduction, refinance the property and pull out another $40k–$60k. This capital becomes the seed for the next investment. Through careful cycling, a single property can lead to multiple acquisitions.

Identifying Emerging Niches for $50k Investors

A crucial aspect of portfolio scaling is understanding which real estate niches are expanding fastest. Some sectors become overcrowded while others experience explosive demand. With $50k, investors have access to several fast-growing niches that were previously unavailable.

Emerging niches include technology-integrated rental housing, renovated mid-market multifamily properties, urban-to-suburban conversion projects, co-living housing designed for remote workers, micro-apartments in dense cities, and purpose-built student accommodation near growing campuses. Each niche has unique rental drivers, demographic demand, and long-term stability characteristics.

Example:

Remote-work migration has created strong demand for single-family rentals in secondary cities. Investors with $50k can participate through fractional ownership, syndications, or targeted rentals, often gaining higher returns compared to pricier metropolitan areas.

Building Resilience Through Market Adaptation

A scalable portfolio must adapt to the real estate cycle. When markets tighten, investors shift toward stable multifamily assets or debt-backed products. When expansion resumes, capital can flow into value-add projects or short-term rentals.

The ability to adapt defines long-term success.

Key resilience principles include:

Staying diversified across markets

Reinforcing passive income streams

Reducing overexposure to speculative projects

Increasing liquidity during uncertain cycles

Repositioning capital as demographic trends evolve

By following these principles, investors protect their $50k entry and ensure that growth continues through various market conditions.

The Role of Technology and Digital Platforms in Scaling

Modern real estate technology platforms dramatically simplify scaling even for investors with modest capital. Automated tools provide access to underwriting data, market trends, rental forecasts, and investment-grade analytics once reserved for institutions.

Fractional investment platforms, blockchain-based real estate tokens, and advanced REIT portals allow investors to deploy new capital quickly and diversify across multiple property types with minimal transaction friction.

Example:

An investor begins with $50k spread across three fractional assets. After receiving quarterly distributions, they reinvest into digital real estate tokens and a private REIT. Within 12–18 months, the portfolio contains five income streams across different markets — all without purchasing a physical property directly.

This model of “technology-enabled real estate scaling” is now one of the fastest-growing paths for new investors.

Preparing the Portfolio for Long-Term Wealth

The ultimate purpose of real estate investing is long-term wealth creation. A well-scaled portfolio built from $50k can eventually grow into a diversified, multi-asset system generating passive income capable of supporting lifestyle goals, retirement, or future investments.

Preserving wealth requires attention to asset protection, stable financing, thoughtful reinvestment, and periodic portfolio reviews. Over time, the compounding effect becomes the primary driver of growth, far exceeding the original $50k input.

Continued Article

Advanced Scaling Strategies for Investors Starting With $50k

Building a long-term real estate portfolio begins with capital discipline, but expanding it requires strategic diversification, responsible leverage, and well-timed reinvestment. At the $50k level, the goal is not simply to access real estate—it’s to position the capital in a way that enables the portfolio to multiply year over year. This stage of scaling focuses on shifting from a single asset or fund into a multi-asset structure capable of producing durable cash flow, appreciation, and downside protection.

One of the most significant advantages of real estate is the flexibility of its scaling pathway. Investors are not limited to linear growth; instead, they can compound capital across multiple layers—equity investments, fractional ownership, rental income, debt instruments, or diversified REIT exposure. This layered approach forms the foundation for long-term acceleration.

Risk–Reward Positioning When Scaling a Portfolio

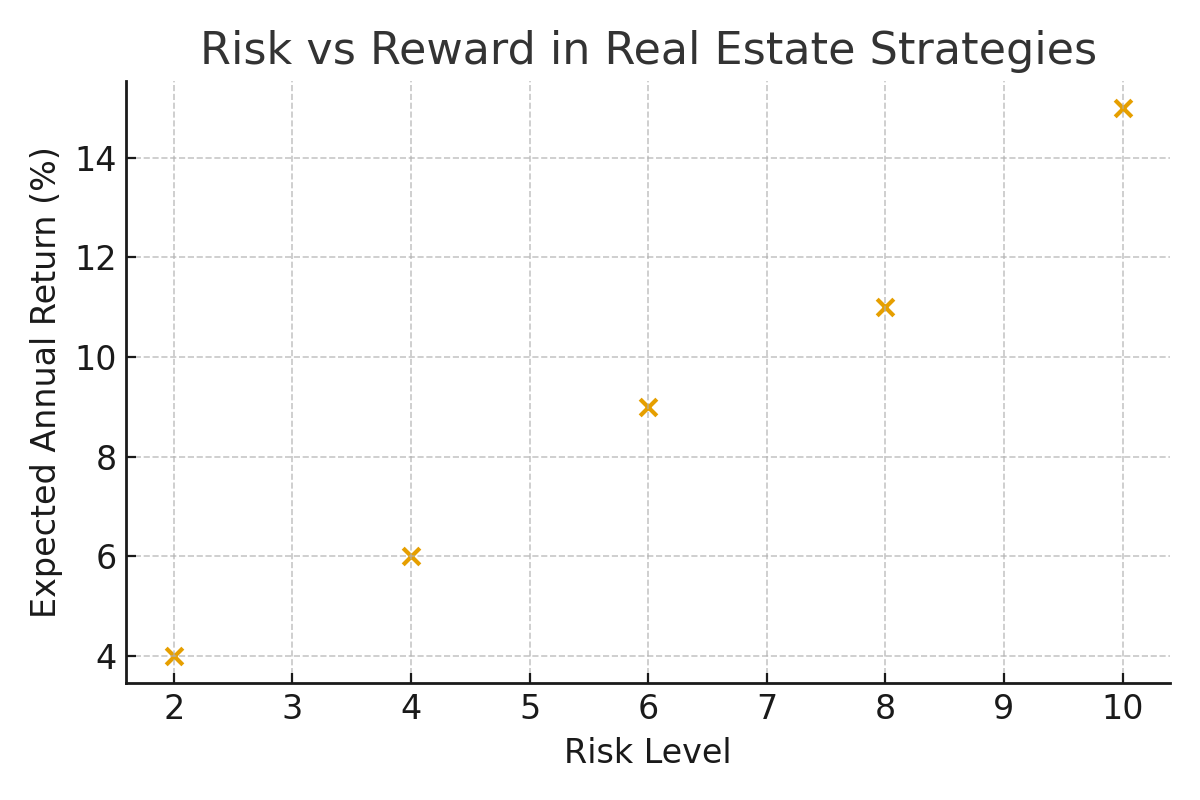

As portfolios expand, risk management becomes just as important as capital growth. Every new investment should align with a defined risk–reward position, allowing for controlled scaling without exposing the portfolio to excessive volatility. The following table outlines how different strategies typically position themselves across the risk spectrum.

Risk–Reward Table for Real Estate Strategies

| Strategy Type | Risk Level | Expected Return | Liquidity | Suitable for Scaling? |

|---|---|---|---|---|

| Core Multifamily | Low | Moderate | Low | Yes |

| SFR Rentals | Medium | Medium | Medium | Yes |

| Value-Add Properties | High | High | Low | Strong if diversified |

| Real Estate Debt Funds | Low | Low | Medium | Yes |

| Private REITs | Medium | Medium | Medium | Yes |

| Opportunistic Commercial | High | Very High | Low | Only selective |

This structure helps investors select expansion strategies without losing sight of long-term capital preservation.

Visualizing Risk vs Reward for Key Strategies

Below is a chart representing the general relationship between risk levels and expected returns across multiple categories. The chart highlights how risk and return typically scale together, guiding investors as they expand into different assets.

Risk vs Reward Chart (Generated Above)

You can download it here:

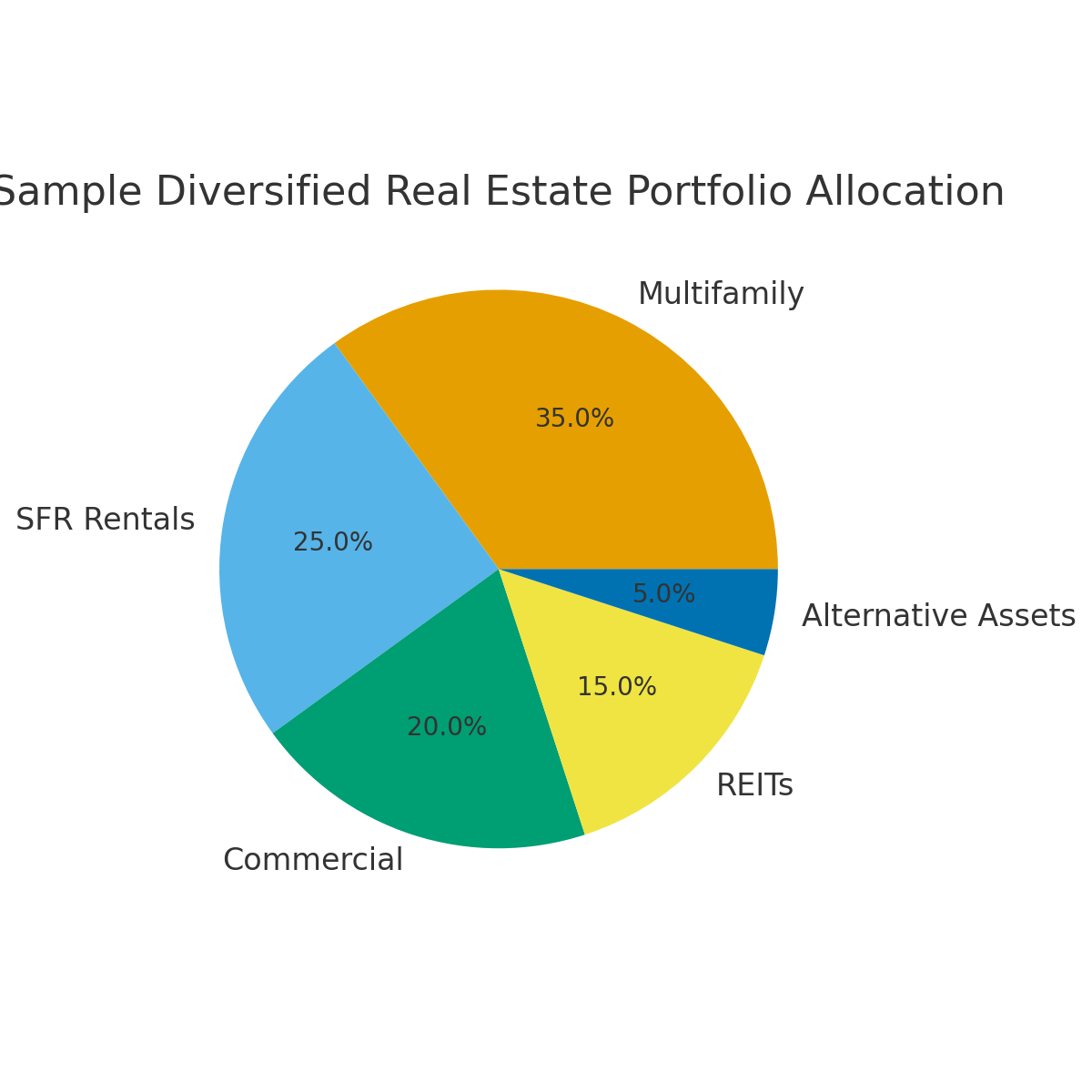

The Role of Diversification in Building a Multi-Layered Portfolio

When the starting point is $50k, diversification must be introduced gradually but intentionally. The goal is not to own a large number of small positions, but instead to construct a balanced portfolio across property categories and income mechanisms. True diversification within real estate spreads capital across various markets, asset types, and risk classifications.

A well-designed diversified portfolio might allocate capital across residential rentals, commercial exposure, stabilized assets, and income-focused debt instruments. Each of these components performs differently under changing market cycles, protecting the investor from downturns while enhancing long-term returns.

Below is a visual representation of a hypothetical diversified allocation model suitable for a portfolio scaling from $50k upward.

Diversification Portfolio Graphic

Diversification Allocation Chart (Generated Above)

Download here:

This graphic illustrates how a balanced approach marries stability, cash flow, and growth potential.

Reinvestment Models That Accelerate Portfolio Growth

Reinvesting returns is the engine that powers scaling. The investor’s job is to ensure every dollar produced by the portfolio returns to the capital base and is redeployed into the next asset. Below are three reinvestment models designed specifically for real estate investors operating at the $50k–$250k range.

Compound Equity Model

This approach centers on placing returns from rentals or REIT distributions back into equity-based assets. Over time, the reinvested equity unlocks access to larger properties and higher-value opportunities.

Staged Acquisition Model

Here, the investor builds upward in tiers. The first acquisition creates cash flow; the cash flow contributes to the next down payment; the new down payment leads to a second asset. This step-by-step approach works well for long-term investors.

Equity Recycling Model

Used frequently by commercial investors, this strategy revolves around refinancing stabilized properties to extract equity and reinvest it into new projects without selling. It allows the portfolio to grow rapidly without losing ownership of core assets.

Table: Comparison of Reinvestment Growth Models

| Model Name | Speed of Portfolio Growth | Complexity | Suitable For | Primary Benefit |

|---|---|---|---|---|

| Compound Equity | Moderate | Low | Long-term, passive investors | Strong compounding |

| Staged Acquisition | High | Medium | Active investors | Faster expansion of holdings |

| Equity Recycling | Very High | High | Experienced investors | Growth without selling assets |

Each model relies on consistent performance but offers different pacing and flexibility depending on investor goals.

How to Expand Across Markets With Minimal Risk

Geographical scaling is another layer of portfolio expansion that can start even with a small entry of $50k. The objective is to balance exposure between stable, predictable markets and emerging, high-growth regions. Investors often diversify across at least three types of markets:

Stable Core Markets

Defined by high demand, lower risk, and predictable rental performance. These markets focus on long-term durability rather than explosive growth.

Growth Markets

Found in expanding metropolitan areas where population inflow, job creation, and infrastructure development fuel rapid appreciation.

Cyclical Markets

Higher volatility but also higher potential upside. These markets require careful timing and more active management.

Example Allocation Across Three Market Types

Below is a conceptual distribution pattern for a portfolio scaling upward from its first $50k investment:

50% allocated to stable core markets for income stability

30% allocated to growth markets for appreciation

20% allocated to cyclical markets for strategic upside

This balance seeks to protect the portfolio from downturns while capitalizing on emerging opportunities.

Strengthening Income Streams Through Multi-Channel Cash Flow

A strong portfolio is not built solely on appreciation; it thrives on multiple cash flow channels. Investors scaling from $50k should target a blend of:

Base rental income

Short-term rental spikes (seasonal or strategic markets)

Profit distribution from fractional commercial holdings

Debt interest income from real estate lending platforms

Dividends from REIT allocations

Each income stream plays a different role in stabilizing performance. Long-term rentals offer predictability, while commercial distributions and debt interest add income stability. REIT dividends contribute liquidity and flexibility, especially when future reinvestments require fast-moving capital.

Common Investor Mistakes and How to Avoid Them

Even with $50k, mistakes in real estate investing can significantly reduce returns. Understanding potential pitfalls allows new investors to protect capital and accelerate portfolio growth. Common errors include over-leveraging, poor market selection, neglecting due diligence, failing to diversify, and misjudging cash flow needs.

Over-leveraging is a frequent issue for investors eager to maximize property exposure. While leverage amplifies returns, it also increases risk. A single vacancy or market downturn can create cash flow problems. Investors starting with $50k should carefully evaluate loan-to-value ratios and maintain reserves for unexpected expenses.

Market selection is equally critical. Buying in high-cost, low-demand areas may prevent a property from appreciating or renting efficiently. Conversely, entering emerging markets without thorough research can expose investors to volatility. Successful investors balance property location with economic fundamentals and demographic trends.

Neglecting due diligence—skipping inspections, ignoring zoning rules, or failing to evaluate management history—can be costly. Even fractional investments require careful review of offering documents, projected returns, and underlying asset quality.

Finally, misjudging cash flow needs can disrupt reinvestment plans. Understanding all operating costs, property taxes, maintenance, insurance, and potential vacancies ensures the portfolio produces sustainable income for growth.

Example Table: Common Mistakes vs Mitigation

| Mistake | Potential Impact | Mitigation Strategy |

|---|---|---|

| Over-leveraging | Cash flow shortfalls, risk of foreclosure | Limit LTV ratios, maintain reserves |

| Poor market selection | Slow appreciation, weak rental demand | Conduct thorough market research |

| Neglecting due diligence | Unexpected expenses, legal issues | Review all documents, inspect assets |

| Lack of diversification | Portfolio volatility, capital loss | Spread across types and locations |

| Misjudging cash flow | Inability to reinvest, financial stress | Analyze all costs and forecast accurately |

Long-Term Strategic Planning With $50k

Long-term planning transforms a modest $50k investment into substantial wealth over time. Investors should define clear objectives, including desired portfolio size, expected cash flow, and risk tolerance. From the outset, strategies for scaling, reinvestment, and diversification must be mapped to these goals.

Investors can use milestone-based planning. For example, the first $50k may purchase a fractional property or down payment on a rental. Yearly, reinvestments and refinances add more properties or fund participation in REITs and debt instruments. By year ten, the portfolio could span multiple asset classes and markets.

Annual portfolio reviews are crucial to ensure alignment with goals. Markets evolve, and demographic trends shift, so adapting allocation strategies is necessary. Adjusting between stable, growth, and cyclical markets preserves capital while taking advantage of emerging opportunities.

Advanced Visualization of Portfolio Growth

Example Chart: Portfolio Value Over Time

Years 1–10 for a $50k starting point with 8% annual cash flow plus 3% appreciation:

Example Chart: Rental Income Growth Over Time

Annual rental income starting from $3,500:

These charts demonstrate compounding effects of reinvestment and property appreciation, providing a visual roadmap for investors.

Final Thoughts: Turning $50k Into Sustainable Wealth

Real estate investing with a $50k entry point is not only feasible—it is strategic. By leveraging fractional ownership, REITs, rental properties, and debt instruments, an investor can create a diversified, scalable, and resilient portfolio.

Key principles for success include:

Strategic diversification across property types, markets, and investment vehicles

Careful reinvestment to leverage compounding growth

Balanced risk allocation between stable, growth, and cyclical assets

Long-term planning and milestone-based portfolio scaling

Continual monitoring of cash flow, expenses, and market trends

Avoiding common pitfalls through research and due diligence

By following these principles, a modest $50k investment becomes the foundation for significant long-term wealth, combining stable income streams with appreciation potential.

Portfolio Visualization:

Diversification Allocation Pie Chart

Risk vs Reward Scatter Chart

These visual tools highlight how balanced allocations, strategic reinvestment, and risk management can amplify returns while preserving capital.